Blog Details

25. How Virtual CFO Services Can Transform Growing Businesses

The life of a growing business—exciting, unpredictable, and occasionally, downright messy. Picture this: You’re the proud owner of a thriving startup. Your products are flying off the shelves (or your services are booked solid), but amidst the excitement, there’s a storm brewing. Your finances are scattered across spreadsheets, compliance deadlines are creeping closer, and your cash flow? Well, let’s just say it’s taking yoga lessons to stretch a little further.

Enter the Virtual CFO—a transformative solution that's reshaping the financial landscape for businesses worldwide by delivering strategic financial expertise without the cost of a full-time executive.

What Is a Virtual CFO?

A Virtual CFO is an outsourced financial expert—such as our firm, H M R R— who offers CFO-level services on a part-time or project basis. From cash flow management to strategic planning, a vCFO provides financial leadership tailored to your business stage and needs.

Let’s dive into how Virtual CFO services can be the game-changer for growing businesses.

1. Strategic Planning Like Sherlock Holmes

Imagine you’re trying to launch a new product, but you’re unsure if you have the budget to market it like a rockstar. A Virtual CFO is like your financial detective—they analyse your numbers, foresee risks, and make a game plan that ensures every rupee you spend is working for your business. Forget guesswork—they help you solve the mystery of profitable growth through data-driven insights and financial modelling.

2. Budgeting Like a Pro Chef

Ever cooked without a recipe? It’s chaos—too much salt, not enough spice. Growing businesses often do the same with their finances. A Virtual CFO crafts a budget that’s the perfect recipe for success, balancing ingredients like payroll, marketing, and operations to whip up a dish that investors and stakeholders will love.

3. Cash Flow Management: The Lifeguard You Didn’t Know You Needed

Cash flow is the lifeblood of your business. Without it, you're drowning in bills and gasping for breath. Virtual CFOs are like lifeguards—they keep your cash flowing smoothly, ensuring you can pay your team, invest in growth, and survive unexpected storms.

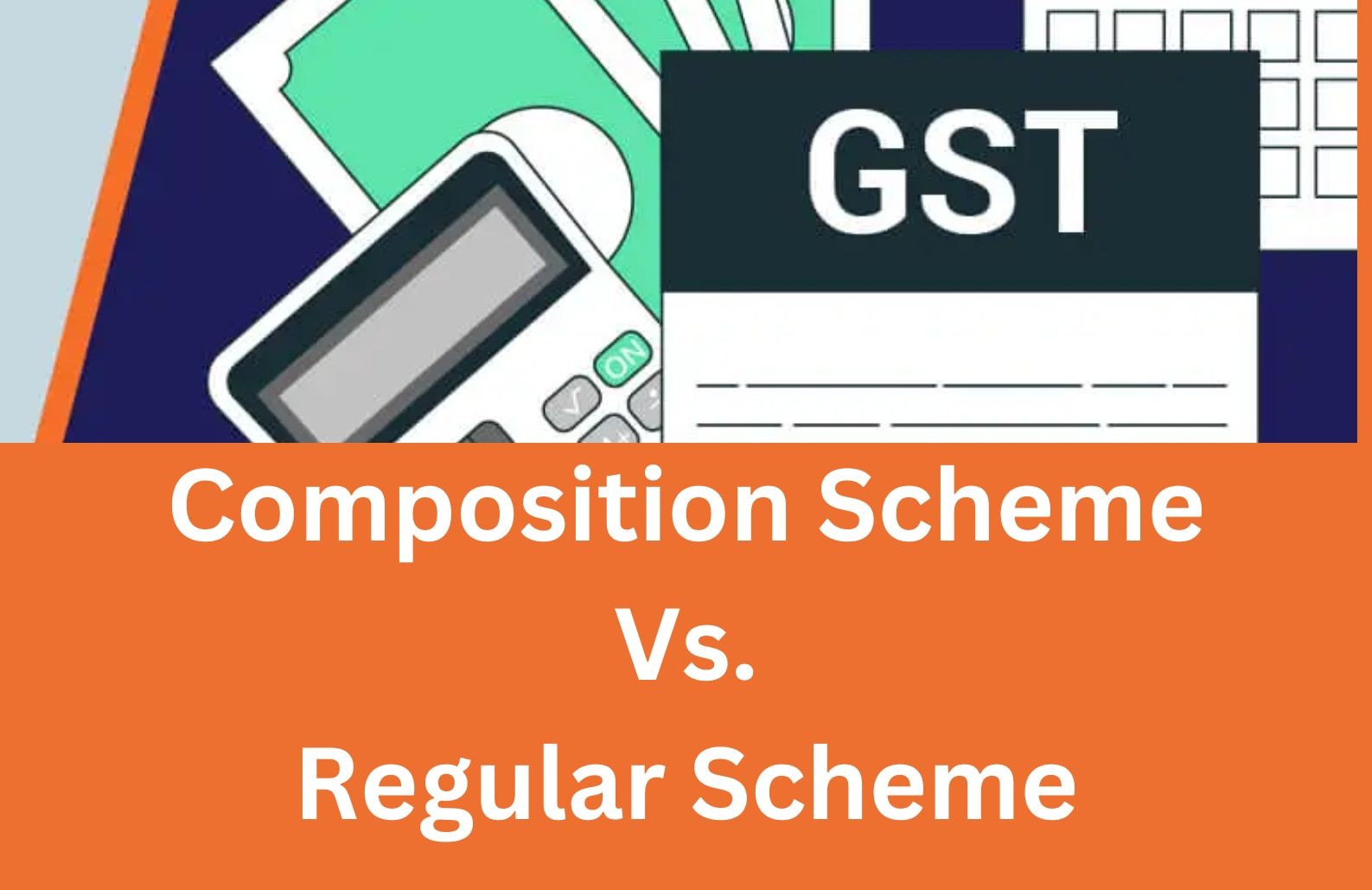

4. Compliance Without the Headaches

GST filings, audits, and regulatory checks—sounds fun, right? (Nope.) Virtual CFOs handle all this boring yet critical stuff for you. They ensure your business is compliant, so you can stay out of legal trouble and focus on what you do best.

5. Scaling Up Without Breaking Down

Growth is exciting, but it comes with growing pains. Need funding? A Virtual CFO will prep killer financial reports and pitch decks. Expanding operations? They’ll help manage the costs and risks. They’re like the coach who gets you ready for the next big league.

6. No Full-Time CFO? No Problem!

Not every business can afford a full-time CFO, and that’s okay. Virtual CFOs work part-time or on-demand, giving you expert-level advice without breaking the bank. It’s like having Michelin-star food delivered—premium quality without the hefty price tag.

Who Should Consider a vCFO?

- Startups preparing for seed or Series A funding

- SMEs looking to professionalize financial management

- Bootstrapped businesses seeking cost-effective leadership

- Businesses expanding into new geographies or services

The Magic of a Virtual CFO

Virtual CFO services are ideal for businesses looking to grow smarter, not harder. They’re there to provide strategic advice, keep your finances in check, and help you tackle challenges as your business evolves. They’re your secret weapon, your financial superhero, your Captain Cashflow.

Let’s turn your financial chaos into organized success—one spreadsheet at a time.

~ Curated by Venkat, Audit Assistant, H M R R & Associates.

Copyright | All Rights Reserved H M R R & Associates