Blog

25. How Virtual CFO Services Can Transform Growing Businesses

The life of a growing business—exciting, unpredictable, and occasionally, downright messy. Pic

24. GST Compliance in 2025: Update Yourself on what’s New

As we enter the fiscal year 2025-26, the GST regime continues to evolve, reinforcing its role as a c

23. TDS/TCS: Key Applicability and Rates for FY 2025-26

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) is an essential aspect of tax compl

22. Gearing Up for FY 2025-26: Key Compliance Deadlines to Keep in Mind

As we step into the new financial year 2025-26, it’s not just about setting fresh goals or cru

21. A Guide on Import and Export Under GST

As India's economy continues to grow, businesses are increasingly venturing into international t

20. Tax Update: TDS on Payments by Firm to Partners (Section 194T)

Our FM Ms. Nirmala Sitharaman introduced Section 194T in Budget 2024, making certain payments from p

19. Franchising vs. Expansion: Make the Right Choice

Expanding a business is an exciting step, but one of the most critical decisions of entrepreneurs is

18. GST Composition vs. Regular Scheme: Choosing the Right Option for Your Business

When registering under GST, businesses can choose between the Composition Scheme and the Regular Sch

17. The Role of Digital Marketing in Accelerating Business Growth

In the past, marketing was often seen as a creative industry and was considered vital to business gr

16. Taxation of Virtual Digital Assets in India

Virtual digital assets (VDAs) like cryptocurrencies and non-fungible tokens (NFTs) have become incre

15. GST on E-commerce: What Online Sellers Need to Know

Imagine you’re running a thriving online store, reaching customers far and wide with just a fe

14. TCS Credit for Foreign Education: A Simple Guide for Parents

Guidelines on How Parents can claim TCS Credit for Children's Foreign Education Planning to s

13. Effective Budgeting Techniques for Small Businesses in a Tight Economy

Thriving in today’s economy requires more than just hard work—it demands smart financial

12. Taxability of Gifts In India

Celebrations, family get-togethers, and friends' hangouts become truly memorable when marked wit

11. GST Update: RCM on Commercial Property Rents

In today’s fast-paced life and ever-evolving business landscape, staying updated on important

10. Compliance Checklist For Starting Your New Business

The essential guide to compliance requirements for starting your new business Imagine standing at

9. Why MSME Registration is a Game-Changer for Small Businesses?

In a rapidly evolving business landscape, micro, small, and medium enterprises (MSMEs) play a crucia

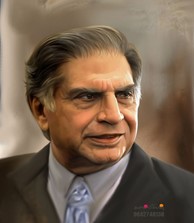

8. The Tata Way: How Ratan Tata Turned Challenges into Business Opportunities

Ratan Tata, the People's Industrialist Whom India Will Adore & Admire Forever In the

7. Choosing the Right Business Structure: A Guide for New Entrepreneurs

Starting a new business is an exciting journey, but one of the most crucial decisions you’ll f

6. Navigating Startup Taxation: A Roadmap to Maximizing Benefits

Start-ups are emerging as the driving force of a New India. To foster this growth, the Government of

5. Section 285BA: Reporting Specified Financial Transactions

Understanding Section 285BA of the Income Tax Act One of the critical components of The Indian In

4. Section 43B(h) of the Income Tax Act, 1961

Applicability: Any entity buying goods or taking services from a Micro or Small enterprise regis

3. Mastering the Art of FD Laddering

Maximizing Returns: The Art of FD Laddering In the world of conservative investing, Fixed Deposit

2. Smart Ways to Save Taxes in India

FY 2023-24 is soon coming to an end, and you've only got two months left to plan your Tax S

1. Interim Budget 2024 - Key Highlights

The interim Budget was recently presented by FM Nirmala Sitharaman in the Lok Sabha. It envisions &#

Copyright | All Rights Reserved H M R R & Associates